What Is The Best Method To Make An Investment In Bonds In 2024?

A smart strategy for 2024 is to invest in bonds for the generation of income, diversification and risk management. Here are the most efficient methods to invest in bonds this year The most popular are: Government Bonds:

U.S. Treasury Bonds are one of the most secure investments due to the fact that they are guaranteed by the U.S. Government. There are three types of maturities that are available: short-term T-bills, medium-term T notes and long-term bonds.

Municipal Bonds. Issued by states as well as local authorities, they often provide tax-free interests income. This is attractive to investors who are more tax-advantaged.

Inflation-Protected Securities (TIPS) The Treasury bonds are indexed to inflation, helping protect against inflation risk.

Corporate Bonds:

Investment-Grade bonds: issued by financially stable companies, with a high credit rating. These bonds can provide moderate returns, but with lower risk than bonds with lower credit ratings.

High-Yield Bonds They are issued by companies that are not able to obtain credit scores. They have a higher return to compensate for increased risk.

Bond ETFs and Funds

Bond Mutual Funds are funds that pool money from multiple investors and purchase a diversified bond portfolio. These funds are managed professionally by fund managers.

Bond ETFs: Like mutual funds, bond ETFs can provide diversification but trade on exchanges just like stocks, offering greater liquidity, and usually less fees.

Bonds International:

Emerging Markets Bonds The bonds of developing countries are more profitable than bonds from developed nations, but also have higher risk due to the economic and political unrest.

Bonds from Developed Markets: Bonds in developed countries are a great way to diversify and stabilize your portfolio.

Green Bonds

Environmental, Social, and Governance (ESG) Bonds They are created to help fund green projects. Investors interested in sustainability and social responsibility could benefit from these bonds.

Convertible bonds:

Hybrid Securities: They could be converted into a specific amount of the company's shares. They can offer both capital appreciation and the income of interest earned from bonds.

Floating Rate Bonds:

Adjustable interest rates The bonds have interest payments which adjust regularly based on a benchmark interest rate. This reduces interest rate risk.

Private Bonds:

Direct lending and private debt : Investments in bonds issued by private firms or via private debt funds could offer higher yields but also more risk. They also are less liquid.

Municipal Bond Funds:

Diversified Municipal Investments (DMI): The funds are invested in an investment portfolio of municipal bonds. They are tax-deferred and diversification between different municipalities.

Laddering Strategy:

Bond Ladders: This entails purchasing bonds with varying maturities. The profits from bonds with shorter maturities are reinvested into securities with longer maturities which help to balance the liquidity and risk while reducing the risk of interest rate fluctuations.

2024, the Year 2024: More Tips

Monitor Interest Rates. Central banks' interest rate policies can influence bond yields and prices. Knowing the current interest rate environment will allow you to make educated decisions.

Credit Quality: Make sure to pay attention to credit ratings when investing in bonds in order to reduce the risk of default.

Duration Management: Consider the duration of your bonds to control interest rate risk. The shorter-term bonds are more resistant to interest rate changes.

Diversification: reduce risk by diversifying across sectors bond and geographical regions.

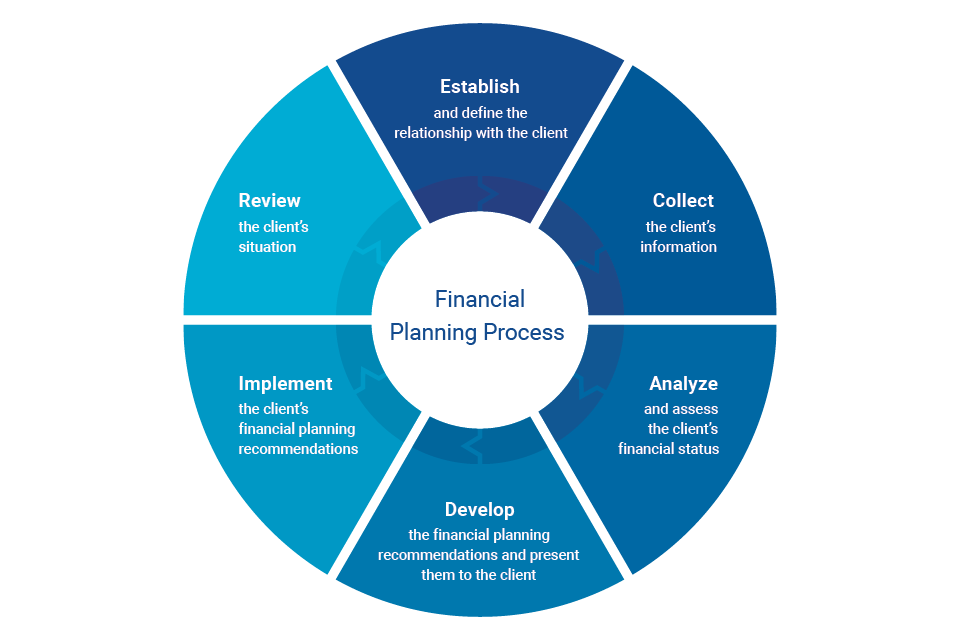

Professional Advice: Consult an expert in financial planning to help you tailor your bond investing strategy based on your specific financial goals.

By carefully choosing and diversifying your bonds, you will achieve an balanced portfolio which will yield income until 2024, helps preserve capital, and minimizes risk. Follow the top Crossfi for more advice.

What Are The 10 Best Methods To Invest In Commodities In 2024?

Commodities are an excellent method to diversify your portfolio and safeguard against uncertainty and inflation. These are the best ways of investing in commodities until 2024. Physical Commodities

Precious metals. When you buy physical gold and silver platinum, palladium and gold you will have an asset that is tangible and valuable. Costs of storage and insurance must be taken into consideration.

Energy Resources Individual investors are not as likely to invest in physical commodities like gas or crude oil because of logistical and storage issues.

2. Commodity ETFs (and ETNs)

Exchange-Traded Funds are funds that monitor commodities' prices and are traded easily on stock exchanges. SPDR Gold Shares iShares Silver Trust and iShares Silver Trust Trust (SLV) are a few examples.

ETNs, also known as Exchange-Traded Notes (Exchange Traded Securities), are a type of debt instrument that tracks an index for the price of commodities. They allow exposure to commodities but do not have physical ownership.

3. Futures Contracts

Direct Investment: Buying futures contracts lets investors bet on the future price of commodities like oil natural gas, wheat, or gold. This is a complex process that requires knowledge of the futures market, and high risk due to leverage.

Managed Futures Funds Professional managers handle the investment in futures contracts, providing expertise and risk management.

4. Commodity Mutual Funds

The funds pool the money of investors and put it into a the form of a portfolio of commodities which can be diversified directly or through futures. They provide expert administration, diversification as well as many different commodities.

5. Commodity Stocks

Mining and Energy Companies (Mining and Energy Companies) It is the act of investing in companies that are involved in the production and extraction of products. For instance, mining companies as well as oil and gas producers and silver and gold miners.

Agribusiness Stocks: Companies engaged in the production of food and agriculture offer exposure to commodities including livestock and grains.

6. Real Asset REITs

Timberland & Farmland : Direct investment in the land used for agriculture or forestry can provide an income and exposure while also supplying commodities.

REITs (Real Estate Investment Trusts): REITs focused on infrastructure and natural resources such as timber or agricultural REITs, provide a means to invest in commodities indirectly.

7. Commodity Pool Operators (CPOs)

These are managed funds that pool capital from investors to trade commodity futures and options. Professional management and lower entry fees are possible.

8. Diversified Commodity Index Funds

The funds are based on a broad index of various commodities, providing diversification across multiple sectors like metals, energy, and agriculture. Bloomberg Commodity Indexes (BCI) and S&P GSCI indexes could be utilized as examples.

9. Gold and silver Coins

Bullion Coins: Coins issued by the government that are made of gold and silver can provide a high level of liquidity for precious metals.

10. Digital Commodities as well as Tokenization

Blockchain-based Commodities : Some platforms provide digital tokens that are supported with physical commodities. These tokens provide a modern and transparent way to make investments in commodities.

Additional Tips for 2020

Diversify across commodities:

Do not invest in one specific commodity. Spread your risk by diversifying across different types (e.g. metals, energy and agriculture).

Understanding Market Dynamics

Be aware of the factors that affect supply and demand such as geopolitical factors, geopolitical influences as well as economic indicators that may affect the price of commodities.

Consider Inflation-Protection:

Commodities act as a hedge against the rising cost of inflation. During periods with high inflation, the cost of commodities may rise. This can reduce your purchasing capacity.

Risk Management:

Commodities are prone to volatility. Use stop-loss strategies and take into account your risk tolerance before investing.

Keep Up-to-date on Regulations:

Commodity markets are always changing. Be aware of any new laws that could affect your investment portfolio.

Get professional advice:

Speak to a qualified financial advisor about tailoring your investment strategy in commodities to fit your financial goals.

When you carefully select and manage your investments, commodities could enhance your portfolio and provide protection against economic conditions in 2024.

What Are The Top 10 Ways To Invest In Startups And Private Equity?

investing in private equity and startups can bring significant returns, however it also carries significant risks. Here are the most effective ways to invest in private equity and startups in 2024:

1. Angel Investing

Direct Investments: Investing directly in early stage startups is typically done in exchange for stock. This is usually less risky that traditional venture capital.

Angel groups Join an investment group or network to pool funds and contribute due diligence. This improves your investment opportunity and reduces individual risk.

2. Venture Capital Funds

Venture Capital (VC) Funds: Invest in professionally managed VC funds that pool capital from several investors in order to create a diversified portfolio of start-ups. This allows you to gain access to high-growth companies that are professionally managed and undergo due diligence.

Micro-VC fund: Smaller and more focused funds that focus on startups in the early stages. They are more secure and have a better risk-reward balance.

3. Equity Crowdfunding

Online Platforms: Use platforms such as SeedInvest, Crowdcube, and Wefunder to invest in startups via equity crowdfunding. These platforms allow smaller investment amounts in exchange for equity. This makes it easier to invest in new ventures.

Due diligence is essential: You should carefully review the business plans, potential market opportunities, and team of each startup prior to investing.

4. Private Equity Funds

Buyout funds: Investing in a private equity fund that restructures and acquires mature companies in order to make operational improvements and eventual profits.

Growth Equity Funds: Focus on investing in mature companies that are seeking capital to expand their operations, move into new markets, and finance major acquisitions.

5. Secondary Market Funds

Liquidity Solutions Investing: Secondary market funds purchase shares of private firms and sell the shares to investors who already have invested. This creates liquidity and also lower entry rates.

6. Fund of Funds

Diversification - invest in funds funds that pool capital and invest in private equity and venture funds. This provides a broad range of diversification, across different sectors and stages.

7. Special Purpose Vehicles

Targeted Investments: Take part in SPVs that are created to pool money from investors for one investment in an individual company or opportunity which allows for targeted and strategic investments.

8. Direct Investments

Private Placements. Participate in private markets that allow companies to sell securities directly to investors who are accredited. Provides investors with opportunities to invest in private companies with high-potential.

To share risks and leverage experience, establish strategic partnerships with other investors or funds.

9. Accelerators for Incubators

Mentorship and Funding: Make an investment into incubators or accelerators that provide seed funding, mentorship, and assistance to startups at the beginning of their journey with equity.

10. Self-Directed IRAs

Tax-advantaged IRAs: You are able to invest in private equity and startups using self-directed IRA, allowing tax-advantaged investment growth. To avoid penalties, make sure you are in the compliance of IRS regulations.

2024 is the year of the future: additional Tips

Conduct thorough due diligence

Market Research: Assess the potential of the market, competition, and scalability of the business.

Management Team - Review the team's track record as well as their experience and abilities.

Financial Projections - Review the financial projections, business plan, and overall health of your company.

Diversify Your Portfolio:

Distribute your investment across different industries, startups and growth stages to minimize risk and maximize potential return.

Understanding the Risks

The decision to invest in startups or private equity comes with a significant level of risk. This is in addition to the possibility of a complete loss. Limit the amount you allocate to your portfolio to this asset class.

Expertise in Networking and Leveraging:

Connections with experienced investors, professionals in the field, and venture capitalists can assist you to access high-quality investment opportunities.

Stay informed of current trends:

Keep abreast of industry trends, emerging technologies, and economic developments that may affect the startup and private equity environment.

Legal and Compliance with Regulatory Law

All investments must meet all regulatory and legal requirements. Consult legal and financial advisers to help you navigate the complexity of private investments.

Exit Strategy:

Understanding your investment exit strategy is important, regardless of whether you intend to sell, merge, acquire, or do secondary sales.

If you follow these tips and staying informed by being informed, you'll be able to effectively invest in startups, private equity and balance the potential for high returns with prudent management of risk in 2024.

Comments on “3 Top Reasons For Investing Your Finances in 2024”